Entrepreneurship and Venture Capital

Nikkei’s Investing in Japanese Regenerative Medicine symposium brought together representatives of four Japanese biotechnology companies and two venture capital firms that are active in the biotech sector. Carrying on from the previous session were Twocells CEO Masaya Matsumoto and Shinobi Therapeutics CEO Daniel Kemp. Joining them from the biotech sector were Yoh Hamaoka, chief financial officer at Shiga-based Takara Bio and Shizuka Akieda, CEO of Tokyo-based Cyfuse. Representing venture capital firms were Shinichiro Komoto, a partner at Eight Roads, and Ken Horne, managing partner at AN Venture Partners.

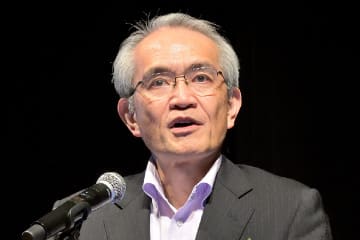

Yoh Hamaoka

Chief Financial Officer, Takara Bio

“Takara Bio dates as a stand-alone company from 2002,” recounted chief financial officer Yoh Hamaoka. “That was when Takara Shuzo [now Takara Holdings, a leading producer of sake, shochu fermented liquor, and other beverages] spun off its biotech business. We secured a listing on the Tokyo Stock Exchange’s Mothers section in 2004, and our shares now trade on the exchange’s Prime market. Takara Holdings retains a holding of about 60% of our equity. Our business spans two main sectors: the reagents and instruments business and the contract development and manufacturing and gene therapy business.” Hamaoka concluded with a detailed overview of Takara Bio’s strengths in contract development and manufacturing, including its technologies for in vivo and ex vivo gene therapy.

Shizuka Akieda

CEO, Cyfuse

“Cyfuse markets bioprinters for constructing 3D arrays of cells to use in regenerative medicine,” explained Cyfuse CEO Shizuka Akieda, “and we are using our bioprinting technology in work on tissue and organs for potential applications in regenerative medicine. That work centers on tissue types for nerve, vascular, and cartilage repair that are in clinical trials. We use either autologous or allogeneic sources for the starter cells, depending on the disease characteristics. Our work also includes developing miniature organs, such as livers and intestines, which we supply to companies in pharmaceutical, food processing, cosmetics, and other sectors to use in product development. Those miniature organs have the potential to replace animal testing.”

Shinichiro Komoto

Partner, Eight Roads

“Eight Roads specializes in investment in the health care sector and has a total of $11 billion under management,” disclosed Eight Roads partner Shinichiro Komoto, “We operate in North America, China, Europe, India, and Japan. Our Japanese operation is our youngest and smallest unit. It has thus far made investments in just six venture companies in Japan, though it has also invested in six U.S. companies whose business has a Japanese angle.” Komoto detailed his firm’s scientific advisory resources and its investment process and commented on issues for the health care ecosystem in Japan. Eight Roads is an investor in Shinobi Therapeutics, and Komoto highlighted that investment as a case study.

Ken Horne

Managing Partner, AN Venture Partners

“AN Venture Partners launched last year,” reported managing partner Ken Horne, “as a biotech-exclusive investment fund with a $200 million target. We had a profound interest in basic research being done in Japan. So we thought about how we could institutionally attack and find cool science in Japan and bring that to the global stage.” Horne noted the “chicken and the egg” problem for nurturing biotech companies, where generating momentum depends on having a compelling success story. “Our goal is to build companies like Shinobi, based on Japanese companies but leveraging the Dan Kemps of the world and bringing U.S. investors to the table. When a company like Shinobi gets bought for a billion dollars, it’ll put Japan on the map. The U.S. venture capitalists will start paying attention, and it will inspire the next generation of Japanese entrepreneurs.”

After the company overviews by Hamaoka, Akieda, Komoto, and Horne, the speakers gathered for a panel discussion. Joining them for the discussion were Matsumoto and Kemp. The panel discussion proved an opportunity for elaborating on points the participants had made in their presentations and to explore other subjects.

Daniel Kemp

CEO, Shinobi Therapeutics

Masaya Matsumoto

President and CEO, Twocells

HOME

Investing in Japanese Regenerative Medicine

PAGE 1

Keynote Addresses

PAGE 2

Authoritative Perspectives on Governing and Nurturing Regenerative Medicine

PAGE 3

Prominent Japanese Venture Companies in Regenerative Medicine and Drug Discovery

PAGE 4

Entrepreneurship and Venture Capital

PAGE 5