As a key industry player, NTT DATA exhibited at Automotive World, the world’s premier exhibition for advanced automotive technologies, held in Tokyo from January 21 to 23, 2025. NTT DATA hosted several presentations and discussion panels.

Explore NTT DATA’s insights on the software-defined vehicle (SDV); the new value of mobility in a software-first age; generative AI’s role in auto production and compliance; and how driving data can detect cognitive decline.

What is NTT DATA’s definition of the “SDV”?

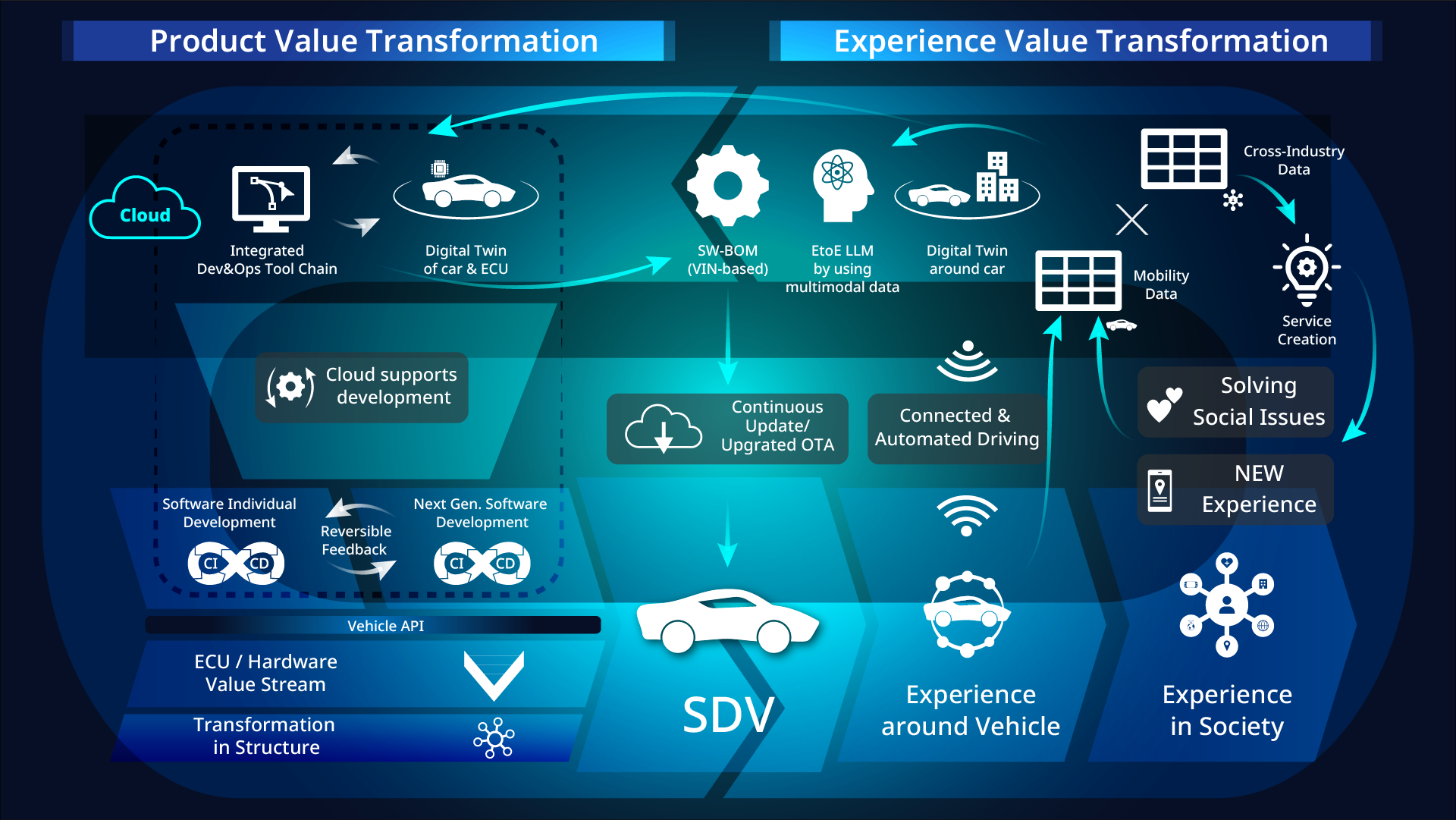

The primacy of software is changing the auto industry, from how cars are designed and built to the mobility ecosystem of customer and service experience. NTT DATA is partnering with OEMs to help them adapt to the new realities.

Traditionally, the auto industry was vertically integrated and strictly siloed. Car companies decided on the functions and hardware they wanted, got their suppliers to make specific modules and combined them in a single vehicle. Increasingly, however, the software is designed first and the hardware built later. “Focusing on the individual systems of individual car models in a vertical design and manufacturing system has gone from an advantage to a disadvantage,” says Toshiaki Takeuchi of NTT DATA Japan. “Companies need to switch to new business processes and organizational models.”

As part of this, car companies will need to collaborate with non-traditional players, especially software makers. But the software-driven transformation is not restricted to the vehicle architecture. Car companies can now create additional value via a digital mobility ecosystem that delivers superior user and service experience on an ongoing basis.

NTT DATA’s broad expertise makes it the ideal consulting partner to help OEMs navigate this disruptive era. “We have a complete ‘SDV worldview’ and cover every aspect of the SDV. We can take a whole-company view and propose joined-up solutions for even the largest car makers,” Takeuchi says.

SDV: Value, future prospects, and the enhancement of customer value

Panel discussion 1 The new value of mobility in the age of software-first

NTT DATA and auto parts and systems provider Denso have a strategic software-development partnership. How do the two companies see the challenges facing the automobile industry?

When Isao Arima joined NTT DATA three decades ago, hardware accounted for the lion’s share of value. It has now moved to software and consulting. A similar shift is underway in the auto industry, as it transitions to a software-first model. “We’re in the world of CASE,” says Hiroshi Kondo of Denso, using the acronym for connected, autonomous, shared and electric. “We’re negotiating a once-in-a-century change.”

The switchover is having multiple impacts, according to NTT DATA’s Arima. Software is now the focus of competitive advantage, and selling aftermarket software updates and services is more important than the initial vehicle sale. The structure of the auto industry has also been upended as the hierarchical pyramid with OEMs sitting atop tiers of suppliers morphs into a free-flowing circular ecosystem where different players collaborate.

“With the SDV, we have to change our mindset as much as our organizational structure,” Denso’s Kondo says. The biggest challenges? Getting engineers to switch from a product-based to a user-experience-based mindset and be open to working with engineers from other disciplines.

That resonates with NTT DATA’s Arima. “As consultants, we go into other companies. The employees often don’t want us there. We have to persist until they suddenly become open to exchanging ideas. Tenacious communication is key,” he says.

Such cross-company collaboration is all the more crucial in Japan because the country lacks a player akin to China’s Huawei, the telecoms company which has developed an OS usable across multiple devices, cars included. “That’s why different companies need to team up, as NTT DATA and Denso are doing,” says Arima.

Speed is a bottleneck. Competitors abroad enjoy an advantage over the perfectionist Japanese because they release products that are 99% complete and fine-tune the final 1% later. Learning from software and mixing agile and mission-critical approaches on a case-by-case basis could represent a solution here, Arima suggests.

Fundamentally, the whole perception of the car has changed. With functionality and comfort taken for granted, consumers now buy vehicles as they buy clothes—to fit their personality. Citing Instacart, a U.S.-based personal shopping service that leveraged data from in-store pickers to expand into advertising and retail support services, Arima expects to see new data-based auto-industry business models emerge that exploit the direct connection with the customer. “Japanese manufacturing is super sophisticated. We want to help make it more dynamic,” he says.

Panel discussion 2 Generative AI in automotive innovation: NTT DATA x Daimler Truck

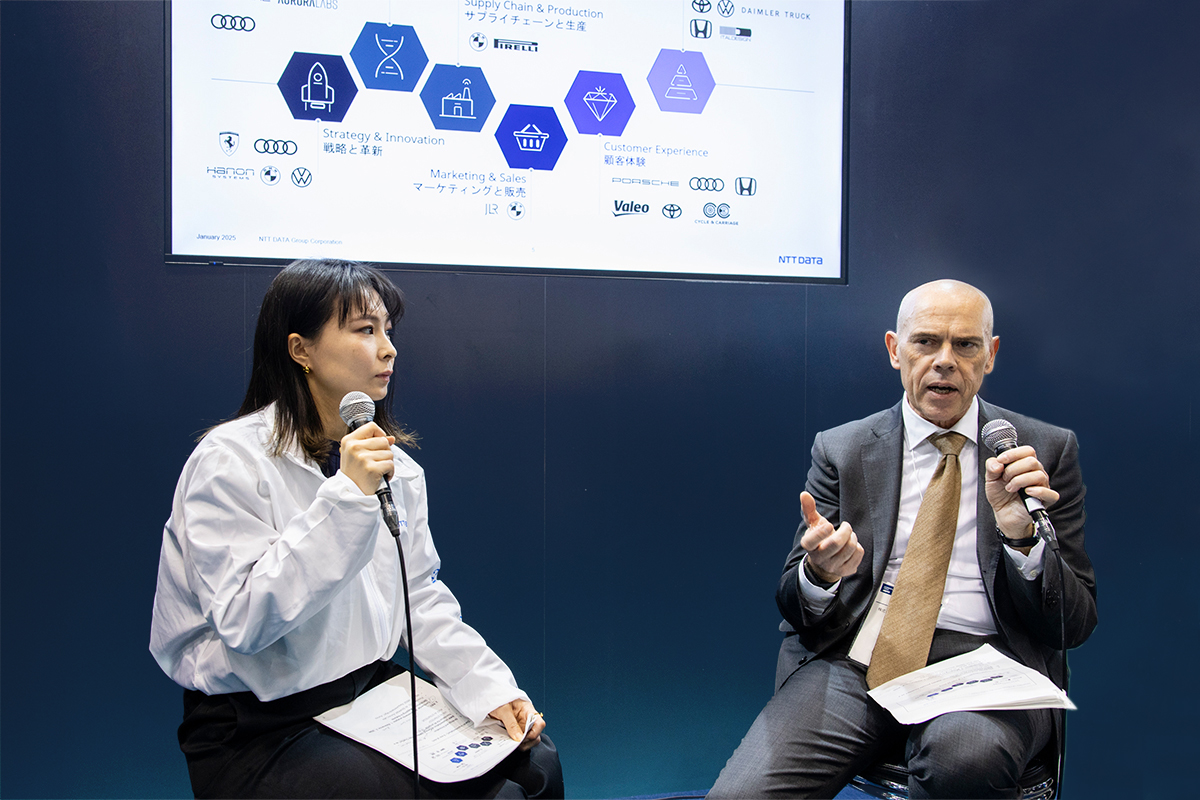

NTT DATA’s global generative AI office is a top 10 global supplier for Daimler Truck. At Automotive World in Tokyo, thought leaders from the two companies exchanged insights on AI’s impact on the auto industry.

“We’ve been here before,” says Kenji Motohashi of NTT DATA. “Once upon a time blue-collar workers in factories were replaced by machines, now programming is taking over white-collar work too.”

Where does that leave humans? Motohashi’s take is positive. “As the working population shrinks, AI can bring down overheads and enable people to focus on creative rather than routine clerical work,” he says. As an example, Motohashi cites an NTT DATA-authored smart accounting agent that automatically categorizes and tallies scanned business-trip receipts into an itemized Excel sheet.

Daimler Truck’s Himanshu Gupta shares Motohashi’s optimism. Recently, large language models (LLMs) have evolved from heavy and power-hungry to practical and economical, plus they are simple enough that anyone can use them. “We want all our departments to use LLMs to boost productivity,” he says.

As the auto industry’s focus shifts from the physical product to software platforms and customer experience, data and AI is driving industry-wide transformation. As well as playing a role in transforming the organizational set-up and the value chain, generative AI can also suggest process efficiencies in production, according to Daimler Truck’s Dr. Dermet Karaali.

Motohashi is looking beyond LLMs to RAG (retrieval-augmented generation), AI that is trained on in-company data to become smarter in a specific business context. “Once upon a time, people designed, built and tested cars. Now AI can do it,” he says.

Gupta expects to see AI agents reduce the time needed to make a vehicle within the next three to five years. Karaali too sees generative AI resolving “pain points” in production, whether through supporting technicians via copilots or enhancing homologation (securing vehicle approvals in different markets).

Both Karaali and Gupta see a role for AI in onboarding and tutoring new employees. “What’s important is to inform our people how best to use AI so they get maximum benefit,” Gupta says.

What will that benefit be? “I like the phrase ‘collaborative coexistence,’” concludes Karaali. “AI will free up human capacity to focus on creative problem-solving. Human’s role won’t disappear. It will be recast.”

Real-life examples of specific software-based solutions

Solution 1 Detecting undiagnosed cognitive decline from driving data

In a rapidly aging society, cars that can keep tabs on elderly drivers’ cognitive state promise society-wide benefits.

With nearly 30% of its population over 65, Japan is a “super-aged” society. The older a society, however, the greater the incidence of cognitive decline. One way this shows up is through an increase in traffic accidents, as elderly drivers misinterpret traffic signs or confuse the pedals.

Suspecting that vehicle driving data could help tackle this problem, NTT DATA partnered with a Tokyo-based cab company to conduct a six-month verification experiment on a group of taxi drivers, all over 65.

A GPS device collected driving data such as acceleration/deceleration status. This was then compared with map and brain health data. “The results were accurate enough to alert drivers to the problem and encourage them to go to the hospital,” says Kanna Chiba of NTT DATA Japan.

Ultimately, NTT DATA hopes to develop a driving-data-based algorithm that will raise awareness and contribute to a safer society for all.

Solution 2 Using AI to accelerate compliance

As the German auto industry seeks to adapt to a changing world, AI is streamlining cumbersome procurement and compliance processes.

The German car industry accounts for 5% of GDP and employs roughly 780,000 people. But transitioning to the SDV era is proving difficult for the country’s flagship companies. On top of the technological challenges of switching to EVs and the commercial challenges from new Chinese and U.S. entrants, heavy regulation is further complicating the picture.

When a car company solicits bids for a new part it sends out a “request for quote” (RFQ), a huge document listing all regulatory and client requirements. Traditionally, these documents were analyzed manually by specialist engineers, a labor-intensive process that did not guarantee perfect results.

NTT DATA has developed an AI-powered systems engineering copilot for German auto parts manufacturer Continental. The copilot automates client and regulatory requirements and maps them against different territories. “It enhanced compliance, freed up the engineers to work on other things, and delivered 50% efficiency gains,” says NTT DATA’s Maho Tanaka.

Homologation is another challenge. Carmakers need to keep track of the different and changing regulations in each country. It is estimated that compliance for a single vehicle type requires around 1,000 documents and 1,000 component certificates. The upshot? Compliance can actually delay product innovation.

That is why NTT DATA has automated the homologation and certification process with CERTassist, a one-stop cross-industry “RegTech” platform. CERTassist handles every stage of the process from overall workflow orchestration to analyzing legal requirements and managing approval data, product registration and even document generation. “CERTassist is a comprehensive solution to support all homologation processes,” says NTT DATA Deutschland’s Gustavo Filip.