Revolutionizing urban air mobility

Brazil’s Embraer, the world’s third-largest manufacturer of commercial jetliners, and Japan’s Nidec, a leading manufacturer of electric motors, are moving to revolutionize aviation. They are working through a joint venture, Nidec Aerospace, to develop electric propulsion systems for urban air mobility and for uncrewed aircraft. Embraer and Nidec launched their joint venture, in 2023, and it has begun fabricating and testing prototypes at its headquarters site in St. Louis, Missouri, in the United States.

Nidec Aerospace CEO Vincent Braley

“Our two parent companies complement each other extremely well,” emphasizes Nidec Aerospace CEO Vincent Braley. “Embraer is a market leader in regional airliners and business jets—a low-volume, high-value business where safety and weight are transcendent concerns. Nidec is a market leader in a diverse range of electrification technology, where applications like automotive and grid stability require top levels of reliability, power efficiency, and size optimization from all of our products.

“Electric-powered aircraft for urban air mobility look to become a large-volume business in a few years, and Embraer has a lot to learn from Nidec about mass production. Meanwhile, the safety standards demanded by such authorities as the US Federal Aviation Agency and the Japan Civil Aviation Bureau require a heightened rigor of Nidec. Embraer has been the most successful of the world’s leading aircraft manufacturers in securing safety certifications promptly, and Nidec can learn from it with respect to relevant regulatory compliance.”

Nidec Aerospace has concluded its initial supply contract for propulsion systems with the Embraer subsidiary Eve Air Mobility. That company is developing electric vertical take-off and landing (eVTOL) aircraft for urban air mobility. Nidec Aerospace’s inaugural customer is thus a corporate cousin, but the managements at Embraer and Nidec are counting on the company to cultivate business with unaffiliated customers, too.

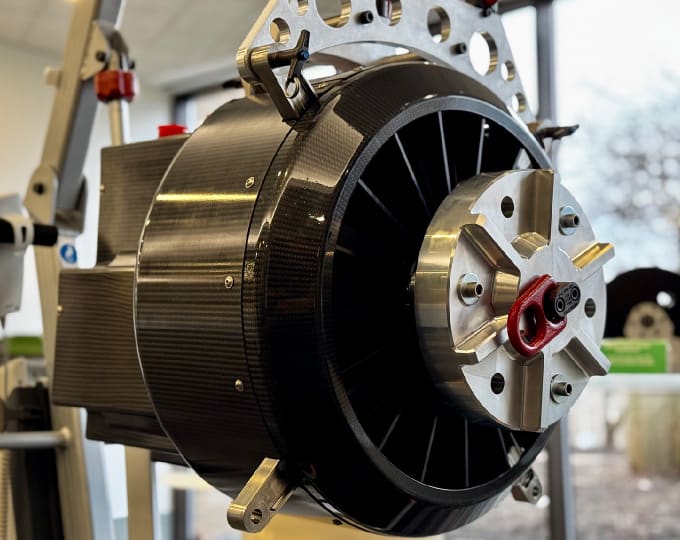

A Nidec motor under development for possible applications in air mobility

“Manufacturers of airliners,” notes Braley, “have traditionally purchased their jet engines from specialty manufacturers, rather than developing and making their own. So setting up Nidec Aerospace as a specialty supplier of propulsion systems meshed with the traditional division of labor in the industry. Our competitors include a lot of startups that are fast on their feet and wield impressive technology, but startups typically struggle with shortages of funding, technical resources, manufacturing capability, and robust process needed to secure necessary government approvals. We benefit from full funding by our parent companies, from access to the world-class manufacturing facilities of fellow Nidec companies, from Nidec’s unrivaled R&D capabilities, and from Embraer’s industry-leading process capabilities in securing airworthiness certifications.”

The International Air Transport Association and the International Civil Aviation Organization have announced a shared commitment to achieving net-zero carbon emissions from aviation by 2050. Fulfilling that commitment will depend partly on shifting a big portion of the world’s air transport to electric propulsion.

“Aviation is the final frontier for electric motors,” concludes Braley. “Nidec Founder and Chairman Nagamori Shigenobu saw that the electric-powered aviation sector was taking off. He was determined for Nidec to get aboard. And he found a perfect partner in Brazil’s Embraer.”

Artist’s rendering of Eve Air Mobility eVTOL in operation (photo courtesy of Eve Air Mobility)

Decarbonizing with green aluminum

Epitomizing the mutually beneficial economic ties between Japan and Brazil is the nations’ cooperation in producing aluminum. The centerpiece of that cooperation is the Amazon Aluminum Complex Project. That project has operated as a Japanese-Brazilian joint venture since 1985 to provide a stable and long-term supply of aluminum for the Japanese market. The Japanese consortium Nippon Amazon Aluminium (NAAC) holds a 49% stake in Albras, an aluminum smelting company in Brazil. The other Albras shareholder is the Norwegian aluminum producer Norsk Hydro.

Japanese corporate and government entities participate in the Amazon Aluminum Complex Project through the consortium. The trading house Mitsui & Co. increased its stake in NAAC in 2024 to 46%, including indirect holdings, from 21%, and became the largest shareholder in NAAC. That additional investment has earned Mitsui an increase in its offtake of Albras’s output to approximately 140,000 tons a year, from 80,000 tons.

Distinguishing the aluminum smelting at Albras is the company’s use of hydropower and other renewable energy sources. Smelting aluminum consumes massive amounts of electricity, and Brazil’s abundant hydropower resources make it a prime source of “green aluminum.” The industry’s general standard for green aluminum is a below 4 tons of greenhouse gas emissions per ton of aluminum produced.

The Albras smelting plant

“Coal- and gas-fired power plants continue to supply most of the electricity consumed in aluminum smelting worldwide,” explains Okajima Naoya, the general manager of Mitsui’s Aluminium Project Department. “Green aluminum supply based on hydropower and other renewable energy accounts for around 30% of total aluminum production. On the other hand, demand for green aluminum is surging globally year by year, recently in Japan also, as manufacturers and consumers of construction materials, automobiles, beverage cans, and other materials race to meet their decarbonization targets.

“For aluminum consumers, simply switching their source to green aluminum can lead to significant greenhouse gas reductions without any technical changes or substantial cost increases,” Okajima continues. “Green aluminum, even with a certain level of premium, is therefore becoming the first choice for consumers.”

Green aluminum ingots produced by Albras

The smelting process for green aluminum is identical to that for other aluminum, and the resultant metal is also identical. Reducing the carbon footprint from the 4-ton threshold for green aluminum to zero would entail, however, some challenging changes for smelters. Most notably, the smelters would need to replace their carbon anodes, which cause emissions of carbon dioxide, to inert anodes.

Albras is the largest green aluminum source for Japan. And Mitsui’s increased offtake volume from Albras leads green aluminum trading in Japan.