More

- Where our mission meets our passion -

September 25, 2023

‘Invest Japan’ Sets Aggressive 100 Trillion Yen Target for Foreign Direct Investment in Japan

5 Policies to Achieve This Goal

Prime Minister Fumio Kishida at the opening ceremony of the B7 Tokyo Summit on April 20, 2023. (Photo provided by the Prime Minister’s Official Residence)

The Japanese government is promoting investment, including bold support to prior investment for GX (green transformation) and DX (digital transformation), while setting the goal of investing 10 trillion yen in startups.

The government is rapidly stepping up activities to invite foreign direct investment (FDI) because of increased expectations for Japan to serve as a production and R&D base as investments and reforms in these strategic sectors continue. Furthermore, the restructuring of global supply chains for semiconductors and other commodities as a result of rising global geopolitical risks, and the most significant wage increases in Japan in 30 years have also served as a tailwind for attracting investment and human resources.

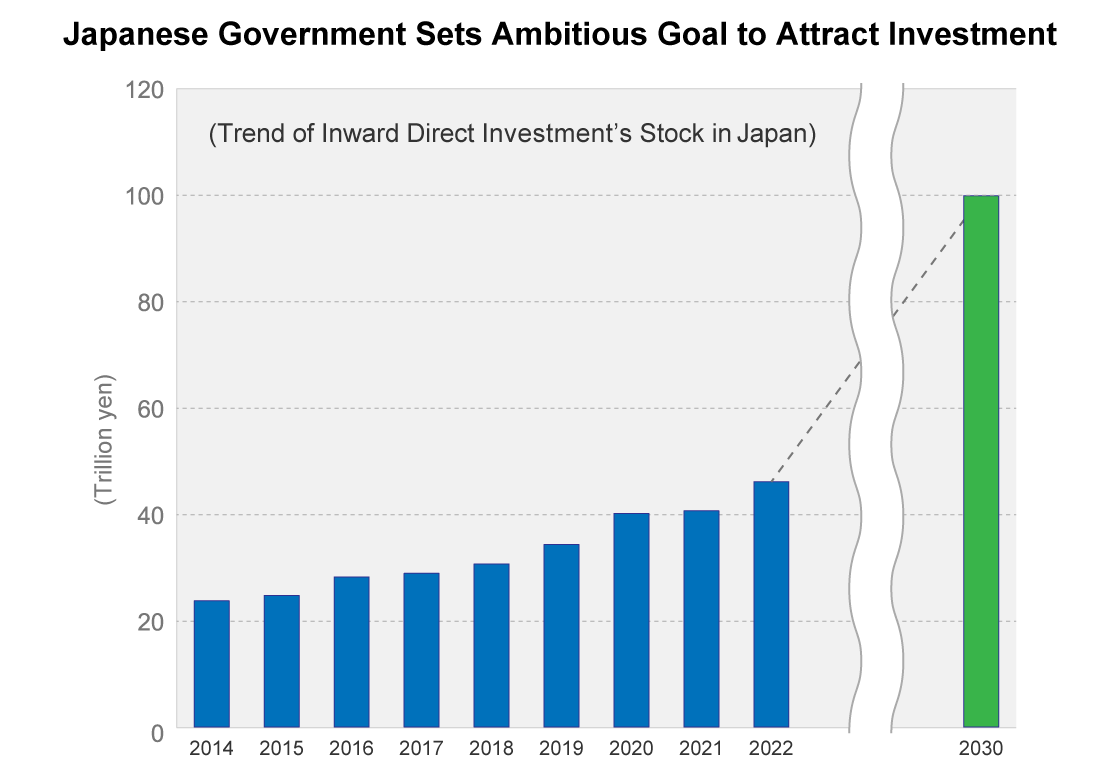

A phrase under the government’s Basic Policy on Economic and Fiscal Management and Reform 2023 (so called the Basic Policy) decided by the Cabinet on June 16 is attracting attention. This refers to achieving the inward FDI stock of 100 trillion yen by 2030 .

The goal set in 2021 was inward FDI stock of 80 trillion yen in 2030(Decision by the Council for Promotion of Foreign Direct Investment in Japan). As of the end of 2020, inward FDI stock was about 40 trillion yen, making it an ambitious goal to double the figure within nine years. However, the Action Plan for Attracting Human and Financial Resources from Overseas announced in April 2023 called for accelerating efforts to achieve the target of 100 trillion yen at “an earliest possible date.” The Basic Policy has set a deadline for achieving this goal, reflecting the Kishida administration’s determination to attract foreign investment. After this Action Plan was announced, foreign diplomatic missions in Japan and economic groups reportedly sent positive messages to government ministries and agencies, noting that the Kishida administration seemed very serious about attracting foreign investment and was eager to make changes.

The assessment that now is the golden opportunity is behind the government’s positive stance. One reason is that with more countries prioritizing economic security, Japan is now in the limelight as one way to diversify supply chains. Another is that the wage increase that Japan has implemented for the first time in 30 years will not only boost domestic consumption but also help attract highly skilled human resources from overseas.

The key to the policy’s success is the prompt implementation of the five pillars put forth in the April 2023 Action Plan:

1)

Stimulate investment in strategic sectors in light of the changes in the international environment.

The Action Plan calls for utilizing the policies to support investment in strategically important fields such as semiconductors, DX, GX, and bio-healthcare, including about 1 trillion yen for the Advanced Semiconductor Fund. A project by industry, government and academia for online matching between foreign and local companies, local governments, universities and other entities was launched in fiscal 2022 and is set to expand this fiscal year, with a second round planned to take place from November to next February.

2) Formulate a strategy for the formation of Asia’s largest startup hub. Investment will be strengthened in global venture capital through the Organization for Small & Medium Enterprises and Regional Innovation, Japan (SME Support, Japan) - the core implementing agency of the national SME policy - and other agencies. On June 8, an event with more than 700 participants was held in Boston in the U.S. to showcase efforts by the Japanese government and industrial sector - especially startups - in the pharmaceutical area.

Prime Minister Fumio Kishida’s video message to “Japan Innovation Night”, an event to attract people’s attention to Japan’s biotechnology activities, held in Boston, the United States on June 8, 2023 (photo from METI’s website)

3)

Attract highly skilled foreign professionals.

The new residency qualification systems (Japan System for Special Highly Skilled Professionals (J-Skip)) was established last April to attract individuals with top-level abilities among highly qualified personnel .

Initiatives are also being considered to attract the “digital nomads” who work regardless of national boundaries.

4) Improve the business and living environment to attract human resources and investment from overseas.

5)

Fundamentally strengthen all-Japan’s efforts for the mechanism to attract investment and to follow up this Action Plan, and globally disseminate these undertakings on the occasion of the G7 and other international events.

A new FDI Task Force will be established in five countries, namely, the United States, the United Kingdom, Germany, France and Australia, through collaboration between the diplomatic missions overseas and JETRO overseas offices. Specifically, in order to provide necessary support for foreign companies seeking to expand their business in Japan, the Japanese government will work with other overseas governments’ related ministries and agencies, and encourage the heads of Japanese diplomatic missions overseas to engage with executives of major local companies and relevant government agencies. Furthermore, the Ministry of Economy, Trade, and Industry (METI) has set up a forum that invites members of chambers of commerce and industry of the G7 nations to disseminate information on Japan’s investment policies and to exchange perspectives with them. According to Fujiko Amano, Director for Investment Collaboration of the Investment Facilitation Division of METI’s Trade and Economic Cooperation Bureau, “Participants from the G7chambers of commerce and industry in Japan showed great interest, asking questions enthusiastically.”

The winds of change have begun to blow. How do the foreign companies that have entered into the Japanese market perceive such changes?

SWAT Mobility, a Singaporean company that provides public transportation and transport solutions in Southeast Asia since its founding in 2016, set up a Japan office in 2020. It has been offering services - including those in the proof of concept stage - in 50 localities nationwide, such as Kitakyushu in Fukuoka prefecture and Hakuba in Nagano prefecture.

In contrast to big cities in Japan, rural areas are suffering from shrinking populations, an issue that is hindering the performance of local bus services and threatening operations. Working with local governments, SWAT is experimenting with on-demand bus services that schedule bus runs according to time and number of passengers via AI-based apps.

Jarrold Ong, SWAT CEO and co-founder, talked about the reason for entering the Japanese market. “Our base is in Singapore. Japan is many times larger,” he said. “Social issues are extremely large [and] it’s a big market with a lot of potential.”

Ong also cited changes in Japan in recent years as another reason. He first came to Japan in 2018 when “starting up business in Japan was much harder.” However, mindsets have changed since then, and the national and local governments have become more flexible in their regulations and speedier in their response. Ong said he is considering further investment to set up a technical team and expand operations.

Business meeting atmosphere at the JETRO Invest Japan Business Support Center. (IBSC). Experts in various fields are available for one-stop consultations on a wide range of subjects, such as setting up a business and identifying partners. Temporary office space can also be provided.

QuantumScape Corporation, a California-based developer of solid-state lithium-ion batteries, opened an office in 2022 in Kyoto. In the field of next-generation batteries, the strength of materials development by Japanese companies is garnering attention. The Japan office will perform core functions, such as strengthening collaboration with regional partners. The new QuantumScape Japan office has a state-of-the-art laboratory for battery research and development. The laboratory is currently hiring engineers. JETRO IBSC supported the company by arranging meetings with city officials and introducing it to service providers such as public notaries and tax accountants.

It appears that FDI in Japan is now beginning to move forward. How will the Japanese economy change going forward? The answer is in the speech by Prime Minister Kishida at the B7 Tokyo Summit of business leaders from G7 nations in April.

“The Kishida government will actively attract human resources and capital from overseas, expand investments in Japan as a whole, enhance its innovation capacity, and increase new business opportunities from abroad, thereby translating them into further economic growth of the country.”

The potential impact is not limited to the influx of capital which will directly boosting gross domestic product. Human resources, goods, capital and ideas from overseas will join forces with resources in Japan to drive innovation. This will achieve economic growth that can overcome the country’s low birth rate and aging population, and give rise to a virtuous cycle of sustained growth and distribution. This is the government’s vision of the Japanese economy.