The growth of startups in Asia continues to thrive. From unicorn startups such as delivery service Grab and consumer internet service Sea, to fintech startups that have gained a foothold in regions expected to see population growth, as well as startups that address global social issues, a wide range of new players are emerging in various sectors.

However, the global “startup winter” that began after the COVID-19 pandemic has now reached Asia. One contributing factor is the stagnation in the funding flow for Asian startups, influenced by recent geopolitical changes in Asia.

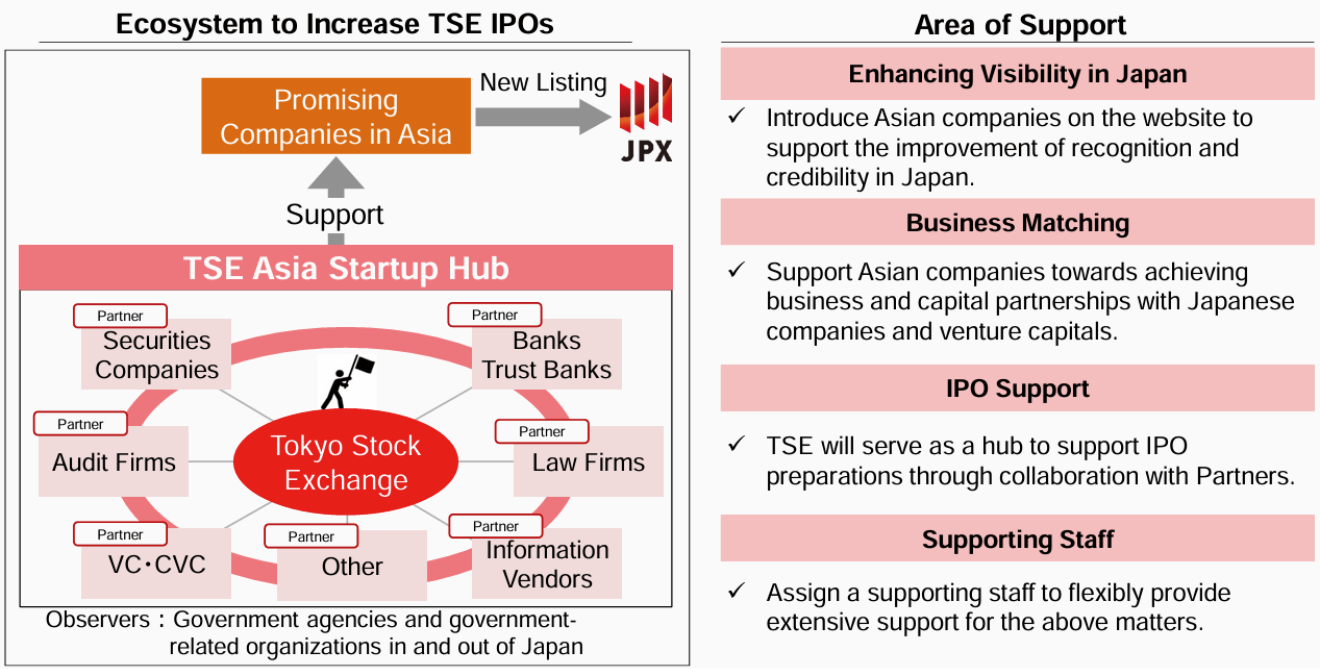

In response to this, the Tokyo Stock Exchange announced the launch of the TSE Asia Startup Hub in March 2024. The TSE will take the lead in this initiative, and major Japanese financial institutions, securities companies, auditing firms, law firms, venture capital firms, etc. will offer business development support and advice to startups aiming for IPOs on the TSE.

In Asia, since around 2013, Japanese VC investment in startups has expanded, leading to multiple overseas startups successfully listing on the TSE since 2021. Amid structural changes in the Japanese economy post-pandemic, Japan has become one of the most watched markets for global investors, while interest from Asian startups has steadily increased.

Japan has long been perceived as a difficult market to enter due to language barriers and high business entry hurdles. The TSE Asia Startup Hub seeks to alleviate these concerns about business development in Japan, with key institutions that have strong connections with large corporations providing steady support for business development. Japan not only gathers some of the world's leading global funds, but it is also the world's third largest economy, making it an attractive market for business. For overseas startups, collaboration with Japan's major corporations, once thought to be difficult due to language and cultural barriers, is now being facilitated through this initiative, which holds significant meaning for the Japanese market.

In September 2024, the first batch of 14 startups with high growth potential from Singapore, Taiwan and other Asian countries was announced by the TSE as companies to be supported. This included unicorn-level startups and those in the artificial intelligence and high-tech sectors. This marks the growing interest of Asian startups in Japan, and beyond the startups announced, there is increasing interest from a broad range of sources.

While these developments are still in the early stages, they reflect the high expectations from global investors regarding the medium and long-term structural changes in the Japanese economy. In the coming years, it is likely that Asian startups will successfully launch IPOs on the TSE and achieve global growth, signaling a significant shift in the region's startup landscape.

The Nikkei 225 index reached an all-time high of 42,224 JPY on July 11, reflecting the changing attitudes of Japanese companies. This rally in Japanese stocks is now seen as a more sustained movement rather than a one-time event.

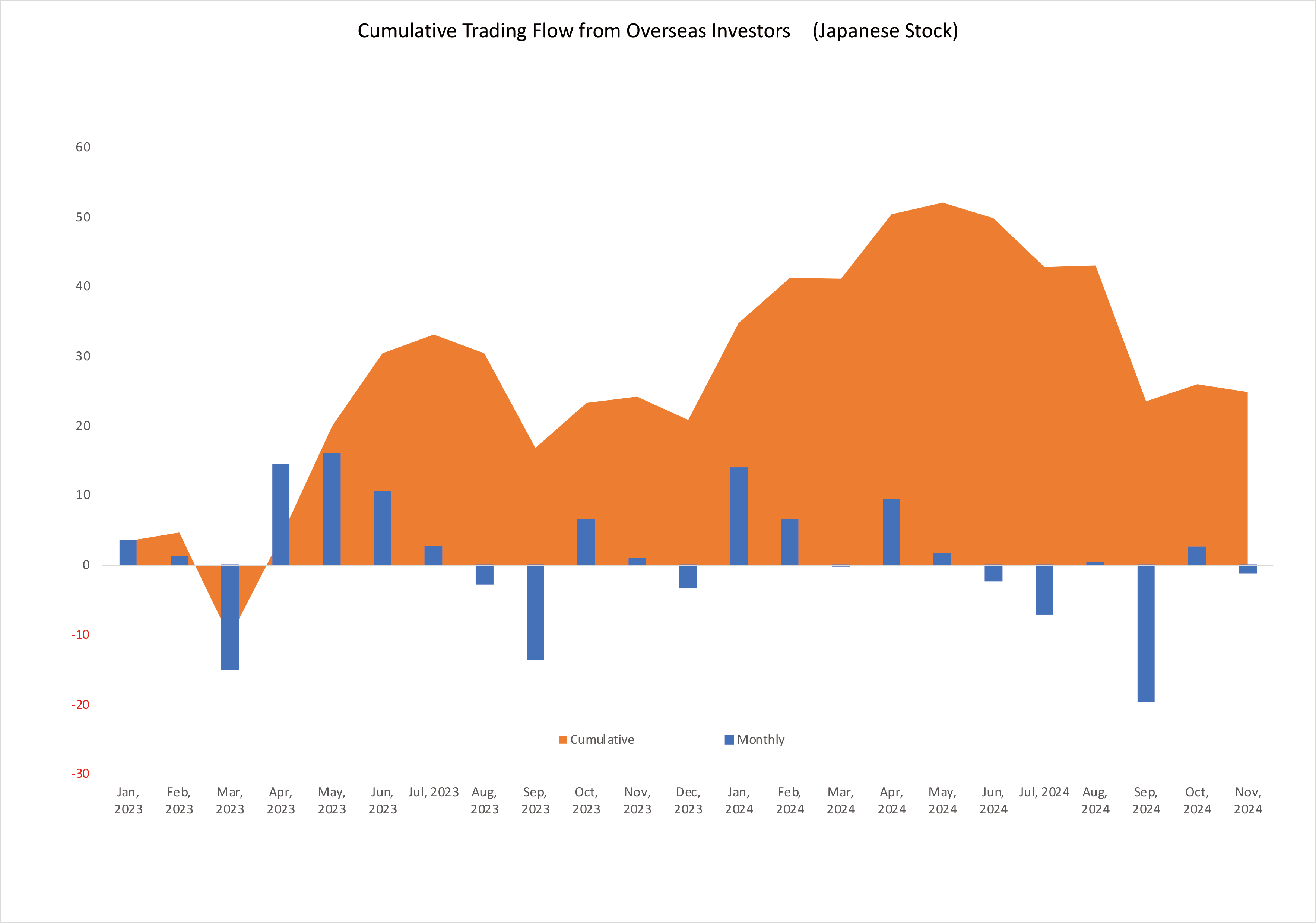

The following chart shows the cumulative inflow from overseas investors into the Japanese stock market. Although there was a large outflow in September, the cumulative total has exceeded $26 billion as of October 2024. This suggests that the changes in the Japanese market are attracting foreign investors.

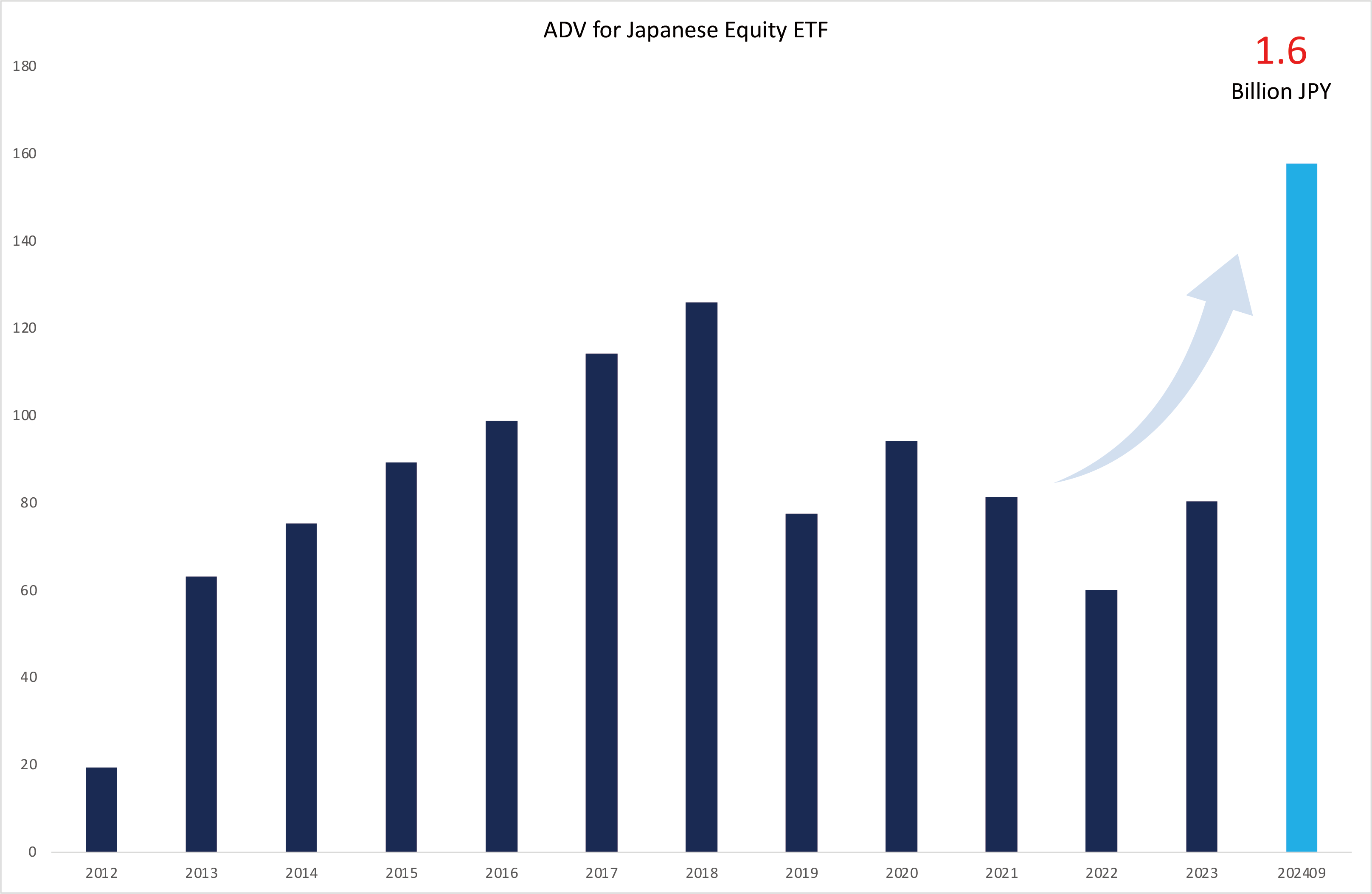

On Nov. 5, 2024, arrowhead, the TSE's equity trading system, was upgraded. Along with the system upgrade, the trading hours were extended by 30 minutes after about four years of study. This is the first time in nearly 70 years that the trading hours have been extended; the 30-minute extension means a 10% increase in daily trading opportunities. Furthermore, in recent years, trading volumes at the recently introduced closing auction have been increasing due to the rise of passive investment. The TSE has introduced a closing auction, in which orders are accepted for five minutes, and then matching is conducted. This scheme will ensure the transparency of the closing price formation and make trading more accessible to a larger number of investors.

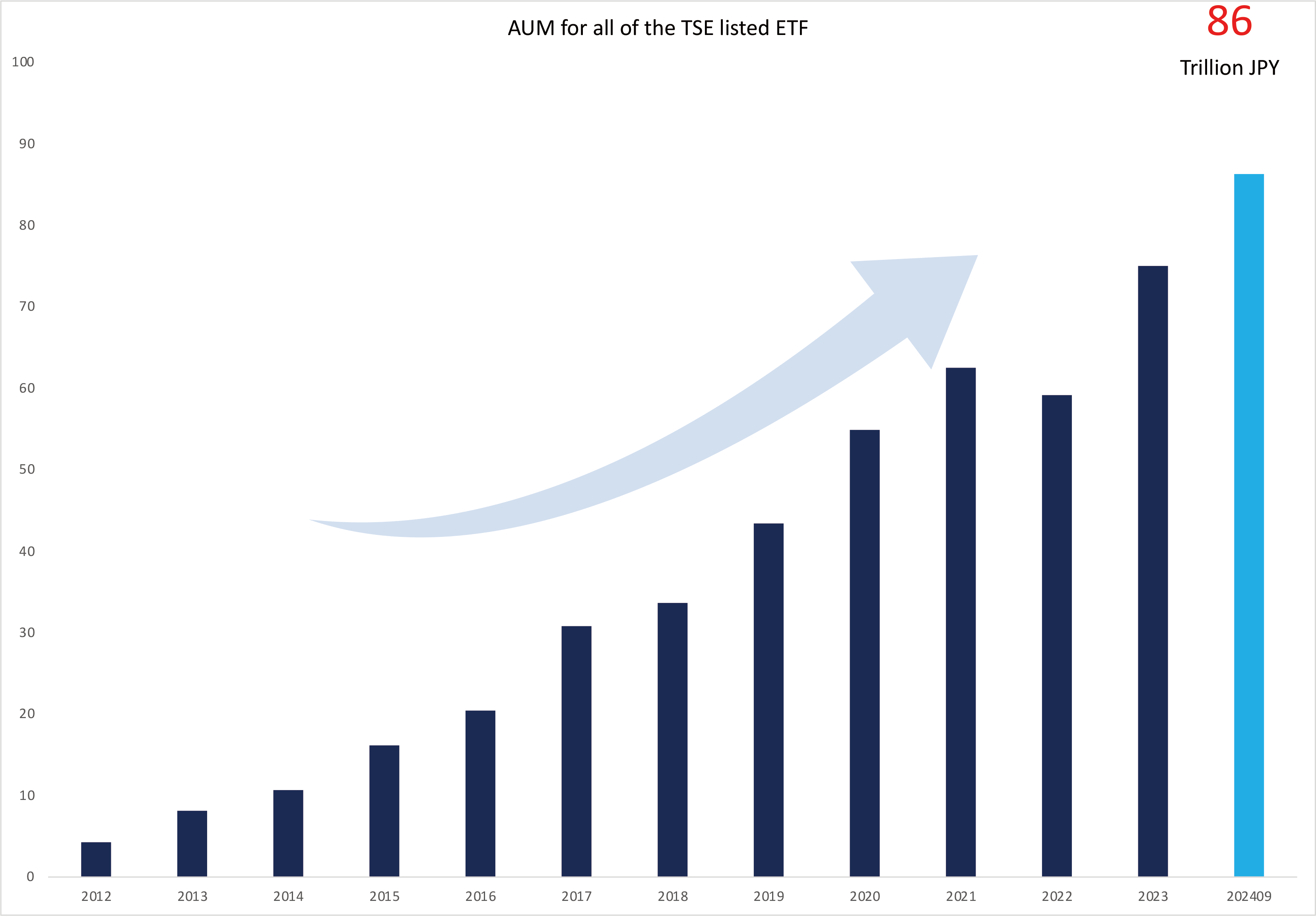

Turning to the ETF market, its expansion has been remarkable, with assets under management (AUM) totaling approximately 88 trillion JPY (about $0.6 trillion) as of December 2024.

Looking back at the ETF market in 2024, the trend among investors using Japanese equity ETFs has been diversification, with inflows into high dividend and thematic ETFs outside the major indices such as TOPIX and the Nikkei 225, and AUM have grown to more than 1 trillion JPY ($6.7 billion). As of Dec. 1, a total of 341 ETFs were listed, of which 81 (about 23%) had listed within the past two years. As high growth rates attract ETF providers, the momentum of the expansion in the number of ETFs is expected to continue.

Another trend is the growing penetration of CONNEQTOR, the exchange owned RFQ (request-for-quote) platform* for institutional investors. The number of users has exceeded 260 companies. In addition, this year various vendors started providing connections to CONNEQTOR with OMS (Order Management system) / EMS (Execution Management System), so that both domestic and international users can seamlessly access CONNEQTOR.

*https://www.jpx.co.jp/english/equities/products/etfs/rfq-platform/index.html